Financial Aid

Financing your education is a major undertaking. WE are here to guide you through it. Call our office at any time at 212.851.1199. No appointment necessary. Our financial aid counselors will assist you every step of the way, from the beginning of your time at the New York College of Podiatric Medicine to the beginning of your post-graduate career and beyond. We can help you understand your eligibility and apply for financial aid, and answer any questions about private or federal loans, work-study, or scholarship opportunities.

Eligibility Requirements

Federal regulations state you must meet certain requirements to qualify for federal student aid (grants, work-study, and loans).

Basic Eligibility Criteria

Demonstrate financial need (for most programs);

Be a U.S. citizen or an eligible noncitizen

Have a valid Social Security number (with the exception of students from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau);

Be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program;

Be enrolled at least half-time to be eligible for Direct Loan Program funds;

Maintain Satisfactory Academic Progress

Sign the certification statement on the Free Application for Federal Student Aid(FAFSA®) form stating that

you are not in default on a federal student loan

you do not owe money on a federal student grant, and

you will use federal student aid only for educational pruposes; and

Show you're qualified to obtain a college or career school education by

having a high school diploma or a recognized equivalent such as a General Educational Development (GED) certificate;

completing a high school education in a homeschool setting approved under state law (or if state law does not require a homeschooled student to obtain a completion credential completing a high school education in a homeschool setting that qualifies as an exemption from compulsory attendance requirements under state law); or enrolling in an eligible career pathway program and meeting one of the "ability-to-benefit" alternatives

Satisfactory Academic Progress

In accordance with Federal and State guidelines, students receiving aid must maintain satisfactory academic progress as established by New York College of Podiatric Medicine, as well as adhere to Touro College's Satisfactory Academic Progress policy.

Standards of Progress

Students must complete at least 80% of their attempted credits and maintain a minimum 2.0 GPA each semester in which they receive financial aid. To remain eligible for aid, students must be on track to complete their medical school education within six years.

Failure to meet these standards will result in financial aid suspension for the upcoming semester. Students whose aid is suspended can appeal. Consult the Student Handbookor contact the Financial Aid Officefor information on the appeals process.

We verify enrollment prior to fund disbursements and review academic records at the end of each semester to determine students satisfactory progress.

How to Apply

New and continuing students must apply for Federal Financial aid every year.

Returning students must be registered for classes before we can process or disburse aid. New students must be fully accepted into the program before we can process aid and registered before aid can be disbursed.

Apply for aid in 6 Steps

Step 1: Create your FSA ID

If you havent done so previously, you will need to create your own FSA ID account to complete federal student aid tasks.

Step 2: Complete the Free Application for Federal Student Aid (FAFSA) on or after October 1st

Complete FAFSA

Documents you will need

Transfer Tax Information to your FAFSA

Do not select "Will File" status

New York College of Podiatric Medicine Code is G02749

Step 3: Review the Cost of Attendance (COA)

The maximum amount of aid applied for in a year cannot exceed the COA for that year.

Step 4: Complete the Entrance Counseling

First time borrowers at NYCPM must complete the Entrance Counseling. This will ensure you understand the terms and conditions of your loan and your rights and responsibilities. You will learn what a loan is, how interest works, your options for repayment, and how to avoid delinquency and default. Make sure to complete the Entrance Counseling for Graduate and Professional students.

Step 5: Sign Master Promissory Note (MPN)

First time borrowers taking out a Direct Unsubsidized Loan must complete and sign an MPN. Direct Grad PLUS Loans require a separate MPN.

Step 6: Complete the Annual Student Loan Acknowledgment each year you accept a new federal student loan.

Once all steps are completed you will receive your financial aid offer and instructions through your student Touro College email. Please monitor your Touro email account daily.

Notes on Financial Aid

In reviewing your application, we may request additional documentation.

Loan funds are disbursed directly to the College to cover the cost of tuition. The Bursar's Officedistributes credit balance refunds within 14 days of receiving the funds.

Federal Direct Student Loans

Understand all your borrowing options. If you have any questions, dont hesitate tocontact us.

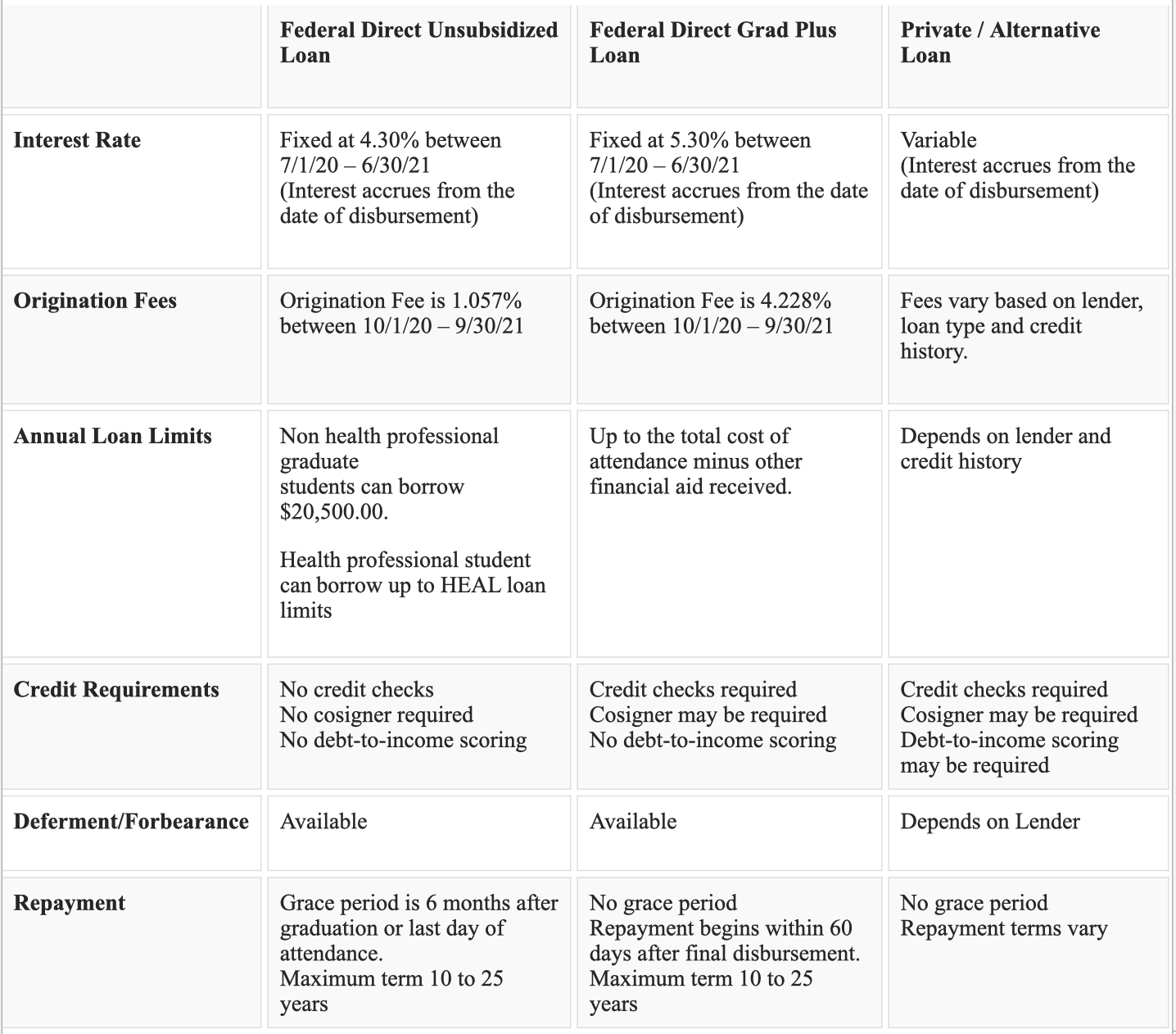

Depending on your level of need, you can apply for aFederal Unsubsidized Loan, aFederal Grad PLUS loan, or a combination of private and alternative loans.

Before accepting any loan, make sure you have a clear understanding of the interest and fees you will pay on it as well as yourrepayment plan options.

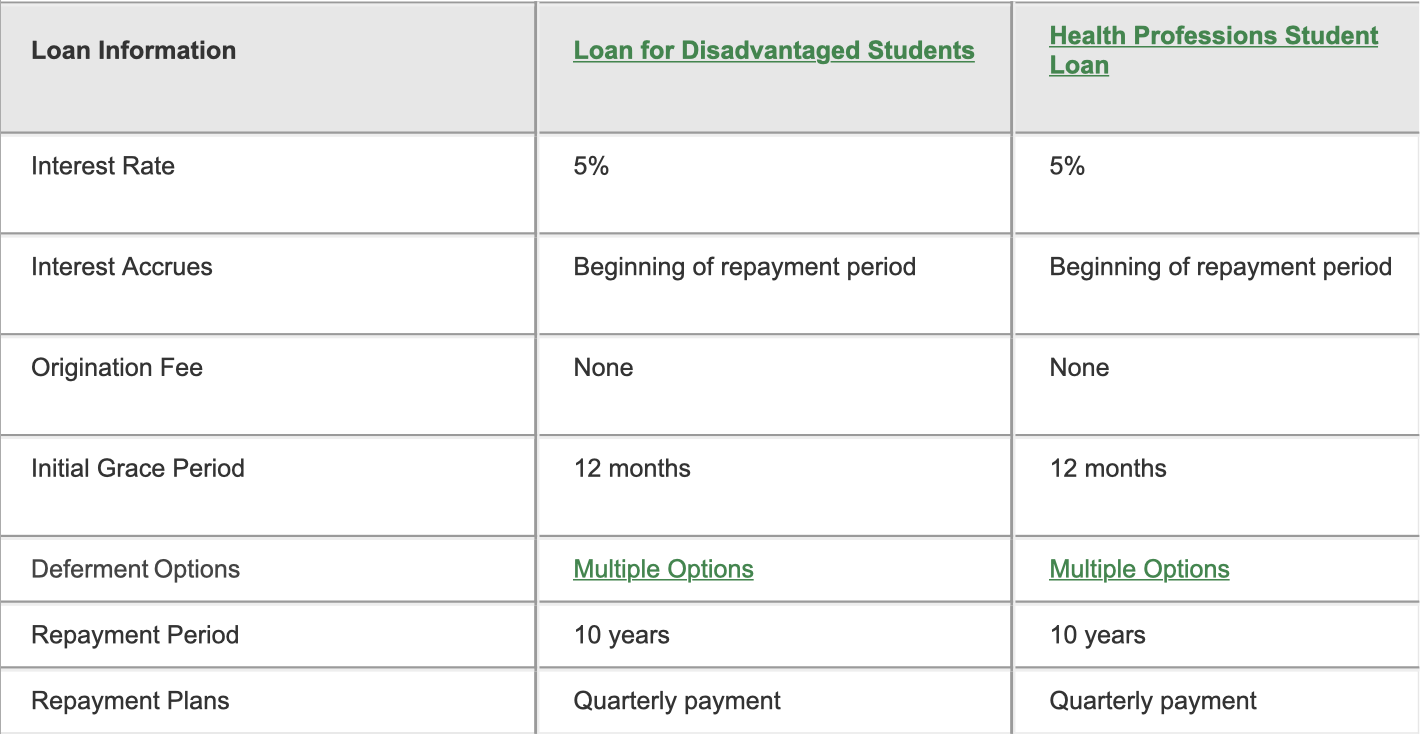

Health Professions Student & Disadvantage Student Loans

The Health Professions Student Loan Program (HPSL) and the Loans for Disadvantaged Students Program (LDS) are long-term, low-interest rate, need-based federal loan programs designed to encourage increased participation of disadvantaged populations in the health professions. The programs are funded by the Health Resources and Services Administration (HRSA). The HPSL and LDS loans have very limited funding and are offered to students based on the availability of funds.

Health Professions Student Loans and Loans for Disadvantaged Students are awarded to students who demonstrate financial need and meet awarding criteria. The amount of HPSL or LDS funds awarded to a student plus the amount of the student's expected family contribution (EFC), including parent contribution, may not exceed the student's cost of attendance. There is no lifetime aggregate maximum under this program.

To be eligible for the Health Professions Student Loan or the Loan for Disadvantaged Students a student must:

Enroll as a full-time student and meet SAP requirements.

Student must be a US Citizen, Eligible Non-Citizen, or Permanent Resident

Have submitted a FAFSA for the current aid year with NYCPM School Code (G02749)

Report parent income and asset information on the FAFSA even if an independent student

Demonstrate financial need

In addition, students applying for Loans for Disadvantaged Students (LDS) funds must be from a disadvantaged background as defined by the Secretary of Health and Human Services (HHS).

Students who want to be considered for the HPSL or LDS loans must contact the financial aid department.

Other Financing Options

PRIVATE ALTERNATIVE LOANS

Alternative or Private Loans are designed to supplement federal, state, and institutional financial aid. Borrowers must be credit worthy and may require a co-signer. The loan programs may vary widely and should only be considered after your eligibility for all other types of aid are exhausted.

We believe the information presented on this site is unbiased, thorough, and clearly presented but you may choose any participating program or lender you wish. Please note that neither Touro College & University System nor any of its employees have received benefits of any kind in exchange for providing this list of lenders on the website.

ELM Select is a tool that may aid you in selecting a private educational loan.

Scholarships

NYCPM has several scholarships available to students.

Please email Dr. Susan Rice at Srice@nycpm.edu for scholarship information.

Work Study

Work Study gives students practical experience while helping them fund their education.

The Federal Work Study Program (FWS) places eligible students in paid positions in various departments throughout the College. Their earnings help cover educational costs. Students may work a maximum of 20 hours/week at a rate of $11-16/hour.

Federal Work-Study Guidelines & Timesheet Intructions

Eligibility

To be eligible for FWS, students must complete a FAFSA and maintain a 2.0 GPA.

Students who fail to make Satisfactory Academic Progress must immediately discontinue Federal Work-Study.

If you cannot report for work as instructed, or no longer want employment, you must notify your direct supervisor. Failure to do so will jeopardize your future FWS eligibility.

Location

Regulations stipulate that students may only work for their assigned department. Working from home is not permitted.

Work Days & Hours

Students may not work:

On Saturdays;

while the college is closed, including intersession and holidays;

during scheduled class time;

more than 25 hours a week.

Students may work up to the last day of their individual finals for each semester.

Timesheets

You must electronically report your time on theTouro One Portal. Supervisors must approve your timesheet for each pay period. Instructions are given when you are approved for Federal Work Study.

Time In & Time Out

Round all hours down to the nearest half hour (e.g. Document 9:15am as 9:00am). Do not use military time.

Breaks

For five hour work periods, you receive a 30 minute break.

For seven-hour work periods, you receive a one hour break.

Your timesheet must show breaks as appropriate.

Entrance and Exit Counseling

Incoming students and first-time loan borrowers need to complete and pass the Entrance Counseling before applying for federal student loans.

Once you have successfully completed the session, your results will be sent electronically to the Financial Aid Office and we will proceed with certifying your loan. Please print a copy of the entrance counseling results for your records.

Students that are graduating, withdrawing, or dropping below half time enrollment need to complete the Exit Counseling.

Policies & Procedures

Awarding Policy

Disbursement Procedure

Financial Aid Reference Documents

Professional Judgment Procedure

Reporting Fraud Procedure

Student Loan Code of Conduct

Verification Procedure

Satisfactory Academic Progress Policy

Repayment of Federal Funds Procedure for Students who Withdraw or Cease Attending

|